Trailing Total Returns Daily Monthly Quarterly Which Is Best

A six-month trailing return represents the gain or loss over a six-month period. The same statistical simulations indicate that there is a 25 chance you might get 25700 or even more of lifetime income per year.

8 Charts On 2021 Market Performance Morningstar

Current and Historical Performance Performance for Health Care Select Sector SPDR Fund on Yahoo Finance.

. Daily returns use prices as of the close of business the previous day. They are calculated every day. Get performance stock data for 02111 Best Pacific International Holdings Ltd including total and trailing returns.

2338 3-Year Daily Total Return. Analysts can evaluate the most recent monthly or quarterly data. What is the calculation to get 7546.

155 1-Year Daily Total Return. Month-end returns use prices as of the last market close of the previous month and quarter-end returns use prices as of the last market close of the previous. I am currently a little bit puzzled.

1 2011 will cover the previous six months from July 1 to Dec. The following monthly returns. It is based on a single point-to-point reading of fund performance.

Get performance stock data for BOTB Best of the Best PLC including total and trailing returns. MSFT-US AAPL-US GE RF month 201505 0008739 0946043 0070769 10. For example the six-month trailing return as of Jan.

The statistic known as trailing twelve months or TTM shows the trailing total return of a fund for the previous 12 months. The total gain of 150 divided by the 10 starting share price produces a 15 percent trailing 12-month return. A decline back to about 15 would improve the margin of safety.

At the close of the last market. I call this the good scenario to distinguish it. The market trajectory and funds performance-near the end of the period has undue influence on entire trailing return.

After calculating trailing returns for a range of. The following Morningstar table shows the daily Trailing Total Return for GOF as of December 8 2021. -1414 YTD Daily Total Return.

The first one is Trailing returns and the second one is Rolling returns. Shares are trading at around 85 times forward earnings and 33 times trailing sales. DfMSFT-US AAPL-US GE RF 1 monthly_total dfgroupbymonthproddropdate axiscolumns Giving us.

As opposed to the traditional methods of publishing return statistics on a quarterly. Trailing Returns Vs. A sharp uptick in recent performance will make returns across all trailing periods look healthy.

So my first guess is that if I had 10000 dollars invested 3 years ago it would be worth 10000 x 11914 3 16911 today. To get compound returns we need to add 1 to each value and then use prod. Let us understand the two in detail with examples of return percent of a few mutual funds.

Using trailing 12-month TTM returns is an effective way to analyze the most recent financial data in an annualized format. Trailing return has a recency bias. 30-Sep-18 1759790658 Performance 29-Sep-18 1759790658 0000 28-Sep-18.

In the following post we provide a more detailed explanation on how to precisely calculate YTD performance using monthly or. The Return Date column displays the as of date for the returns listed in that view. Reporting the highest total net returns in the trailing 5-year period.

A companys trailing 12 months represent its financial performance for a. 7 of the Best Value Stocks for 2022 to Buy Now. For example as of the most recent quarter ended March 31 Rydex Dynamic NASDAQ-100 2X Strategy posted a one-year trailing return of a whopping 3676 and more modest three-.

5612 1500 -227 equal 7546 for the quarter. Trailing returns are the returns that measure the performance of a mutual fund for the past specific periods such as 1 yr 3 yr 5 yr or inception-to-date basis. It is possible to calculate the YTD return using monthly returns but the formula for doing so depends on the types of returns you are working with.

Trailing 12 months TTM is the term for the data from the past 12 consecutive months used for reporting financial figures. Published Returns The mutual fund industry has. With the advent of the internet and the widespread availability of data the mutual fund industry has begun publishing monthly updates on their funds trailing total returns.

For example for USNQX the display has a Trailing Total Returns section showing the 3-year return was 1914. Bluerock Total Income also reported a new monthly record of. I am trying to compute the monthly returns from a set of data.

However the Morningstar Summary shows 1914 was the 3-year pretax return with a tax-adjusted return.

Energy Was The S P 500 S Best Performing Sector In 2021 Can The Outperformance Continue The Motley Fool

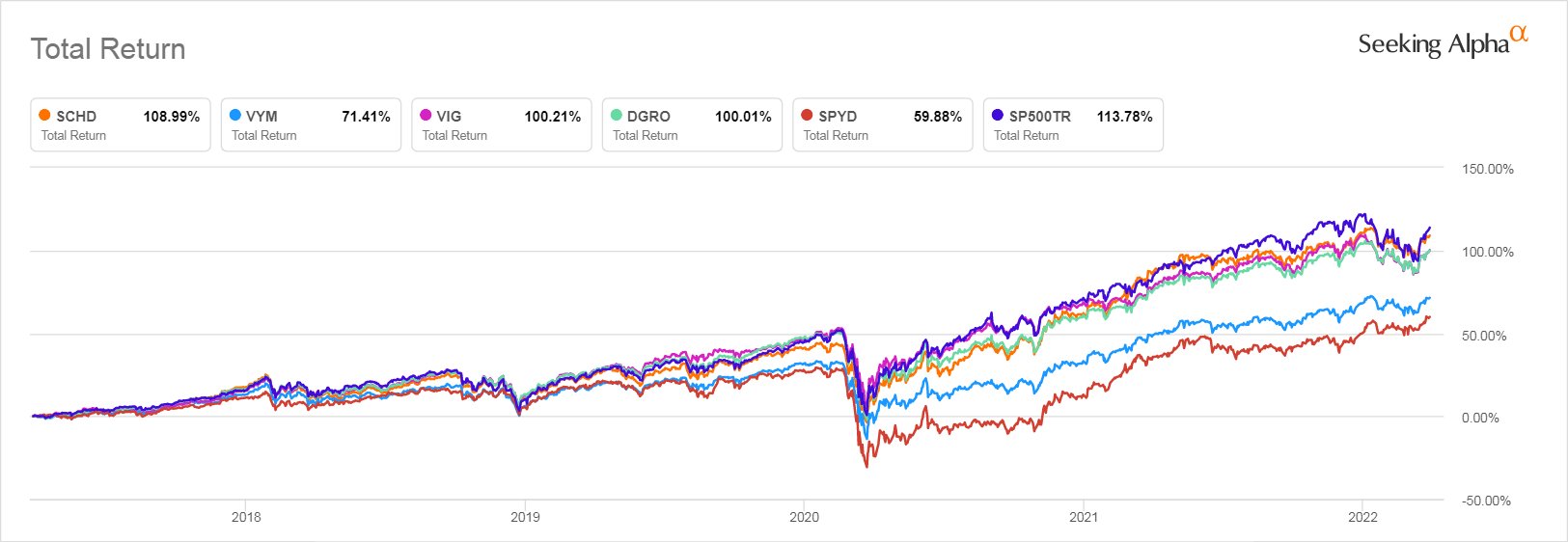

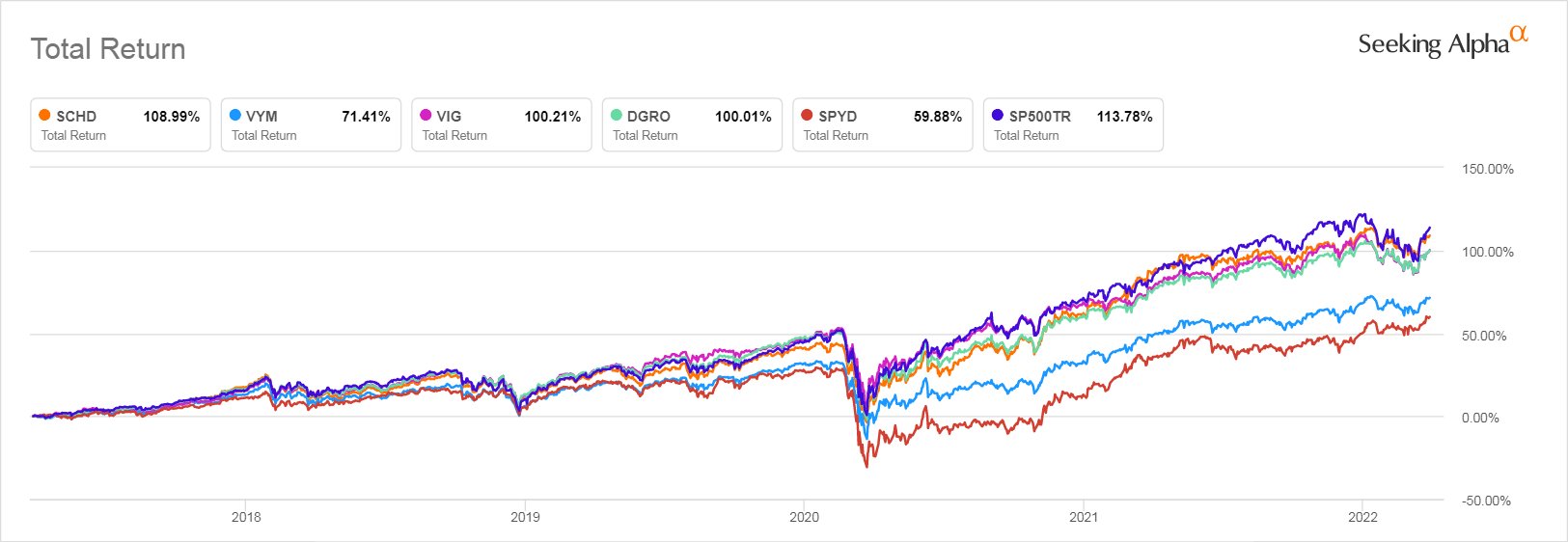

Is Schd Still A Good Choice For Dividend Investors Nysearca Schd Seeking Alpha

:max_bytes(150000):strip_icc()/AdvancedCandlestickPatterns1-f78d8e7eec924f638fcf49fab1fc90df.png)

Comments

Post a Comment